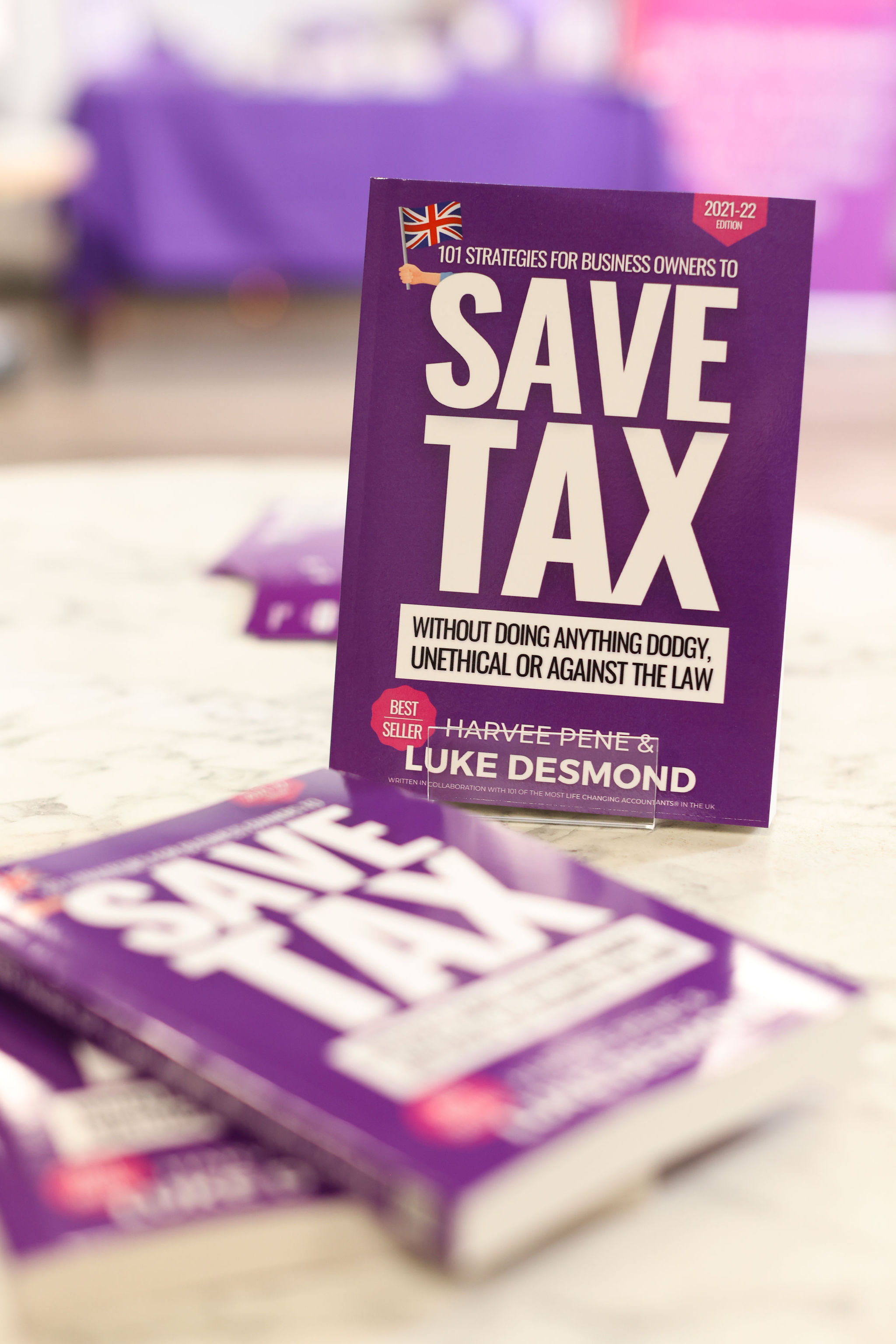

101 Strategies for Business Owners to Save Tax

Paying too much tax is almost everybody's least favourite thing to do - it's expensive, it impacts your livelihood and makes things profoundly uncomfortable.

Look, there's nothing wrong with paying your fair share of tax do you even know what that is more importantly, how to ensure you don't pay a penny more?

Save Tax may well be the difference between you paying what's fair and giving 'til it hurts!

If you want to tip the Treasury every time you pay tax, that's fine, but if you're striving to support your family, your business or your dreams, you might want to save tax instead - and to achieve that you will need a trusty and reliable guide.

Download a FREE copy now!

There’s nothing wrong with paying your fair share of tax but do you even know what that is and more importantly, how to ensure you don’t pay a penny more?

Save Tax may well be the difference between you paying what’s fair and giving ‘til it hurts! Get your copy of 'Save Tax, 101 Strategies for Business Owners' franchise series by Luke Desmond & Harvee Pene.

Testimonials

Save Tax is a must-read for any business owner looking to navigate the labyrinth of taxation successfully. It not only saved me money but also equipped me with the knowledge and confidence to make sound financial decisions for the long term. Highly recommended!

The way Luke wrote "Save Tax" is super easy to understand, breaking down tricky tax stuff for all kinds of readers, whether you're a business pro or just starting out. This book is like a handy tool that helps you feel confident and make smart money choices, no matter where you are on the financial knowledge scale.

Tax, Tech & Tactics

Gain valuable insights into the small business landscape through an expert financial lens, as we explore the intricate intersections of taxation, technology, and strategic approaches to help entrepreneurs thrive.